Objective

Investment Objective

This Fixed Income Notes seeks a high level of debenture interest by investing primarily in high-yielding, sub-investment grade or non-rated debt securities of issuers that have their head office or majority of their activities in the Greater China region (including China, Hong Kong, Taiwan and Macau) as average chinese bond yield rate is higher than the rest of the world.

This region includes certain countries considered to be emerging markets. This Fixed Income Notes will suit those investors seeking high income and who are prepared to accept the risks associated with this type of investment.

The type of debt securities in which the fixed income note will primarily invest will be subject to high risk, including but not limited level-coupon bond and high yield bond. It will not be subject to minimum credit rating standard. Not all securities will be rated for creditworthiness by an internationally recognized rating agency.

The fixed income note may invest its net assets directly in onshore China fixed income securities listed or traded on Eligible Markets in China for bond recurring interest. The manager is not restricted in his choice of companies either by market sector or industry, and will choose investments largely determined by the availability of attractive investment opportunities.

Growth Opportunity

China is one of the fastest growing economies in the world

Since the implementation of the initial Open Door Policy in 1978, China has experienced rapid development—making it the world’s second largest economy in nominal terms.In the next year, the country will move into the next phase of opening up its economy by lifting restrictions on the foreign ownership of securities, insurance, and fund management firms, and this will make the economy more accessible to the outside world than ever before.

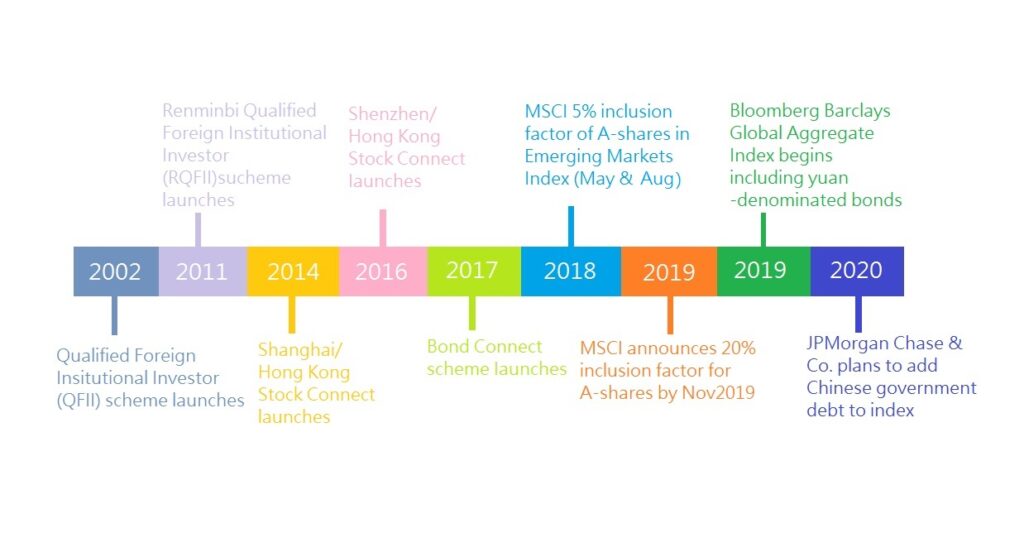

China’s economic circumstances present a compelling opportunity, but current investment processes must evolve in order for investors to tap into this market. Today’s infographic from DYN explores the steps China’s markets have taken to attract foreign capital on a global scale.

China will inevitably face unprecedented challenges as it proceeds to lead global economic growth. However, China’s changing economy is creating a new landscape of opportunity for potential portfolio growth, and they may continue to do so for the coming years. If foreign investors exclude China from their portfolio, they may risk missing out on the explosive potential of this vast market. China’s economic circumstances present a compelling opportunity, but current investment processes must evolve in order for investors to tap into this market. China already has the world’s largest robot market and the government is actively promoting the robotics industry with tax reductions and special R&D funding.

China’s moves are funding the nation’s next stage of growth, and are also creating new investment opportunities for foreign investors.Not only is China now more open to investment, it is also the source of new business opportunities-driven by a growing middle class and domestic consumption. China already has the world’s largest robot market and the government is actively promoting the robotics industry with tax reductions and special R&D funding.