Home

Guiding your investment growth in China

Performance

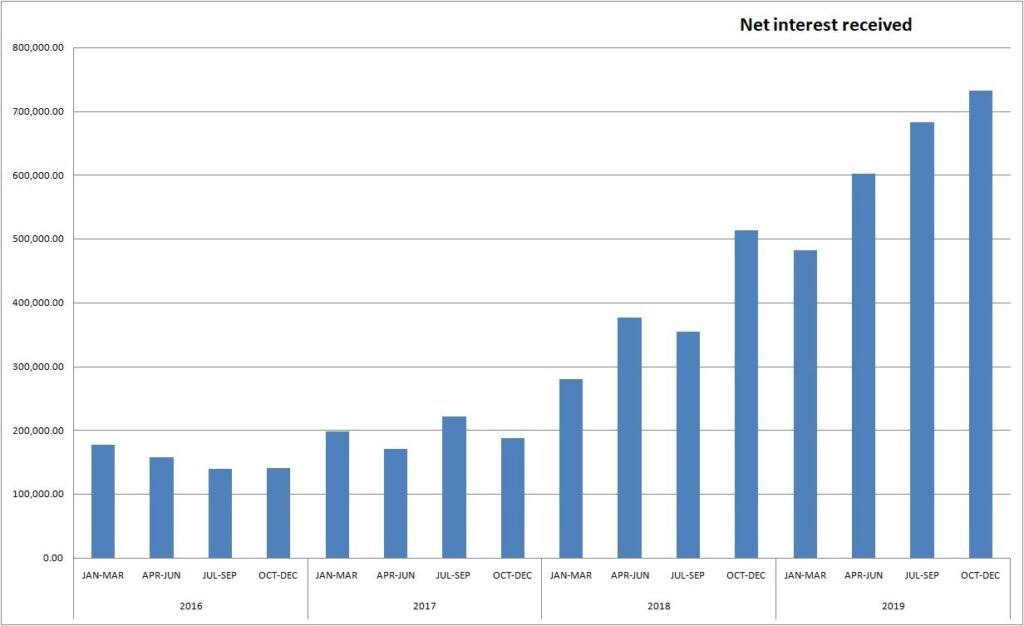

174 people have invested over US$5.2M and earned $624k

Start with DYN today

– Passive income made simple

– 4 years track record

– Start with a minimum of US$5

Local Expertise

For decades, our close and continuous involvement on the active primary and secondary market has helped us to better understand the needs of the industry and local opportunities as well as related restrictions.

Deeper Understanding – Our investment managers are all over a decade of on-the-ground Chinese market experiences. This local footprint and demonstrated experience benefits our clients by commanding a deeper understanding of how China’s unique markets will react to political, economic, and social changes. In comparison to Western firms investing in China, these insights allow our fund managers to intuitively interpret how different market forces, pressures, and culture should influence market pricing and risk. Through these advantages, we produces the potential to outperform.

We incorporate critical analysis, unique insight, and rigorous risk management procedures into the full range of investment styles, resulting in better investment products oriented toward long-term performance and gains.

Powerful Investment Strategies – Throughout our history in China, especially in trading onshore china bond, we have received praise for its expertise and experience across a range of innovative investment opportunities. Spanning asset classes and investment styles, these diversified growth strategies address a variety of investor needs, preferences, and objectives, delivering measured results to our clients. Our methods and long-term performance record have been recognized through numerous awards on both the organizational and fund level.

Why Us

About Us

ifundtrust is a China Bond Robo Advisor developed by DYN Limited. DYN Limited is a Fintech company under the advisory of HAB Management Limited a SFC Type 4 & 9 Licensee. We aim to apply machine learning algorithms with historical transactions and other market data to search for best investment opportunities.

Our Team

Our Team has extensive experience in China market and knowledgeable in the china bond fintech ecosystem, saving you a lot of efforts.

Restructure

Bonds are initially for institutional investors.

We divide it into smaller proportion to fit different investors.

Flexibility

Allow corporate investors to have flexibility to invest with a very low amount of money to start with.

Safe to Invest

Supervised by China Banking Insurance Regulatory Commission.

Why China?

China’s growth rate is high.

It is the world’s second largest economy.

Machine Learning

Machine Learning algorithm significantly enhances return.

Hong Kong Custodians

Investments securely custodied and supervised.

An opportunity too big to ignore

The World Bank describes the pace of growth of China as the fastest sustained expansion by a major economy in history. However, annual economic growth has not always translated into comparable growth in domestic stock markets. In 2020, China plans to lift restrictions on foreign ownership. Combined with a simpler process for onshore investments, this creates an entirely new investment opportunity – an opportunity that can no longer be ignored.

Testimonials