Know More

Know More

What is Fixed Income Notes?

Designed specifically to offer investors a bank-secured, flexible and convenient way of accessing the China financial market without the hassle of ownership. Fixed Income Notes are a hands-off alternative to volatile securities investments. Our Fixed Income Notes assures that you are taking full advantage of your savings and exceeding the returns offered by the more conventional platforms.

Learn More

Works in the same way

- As a Corporate Bond and are a great way to invest in China banks

Without the hassle

- It is a hands-off alternative to volatile securities investment

Tax Friendly

- No sales tax or VAT

- No withholding tax

- No capital gains tax

- No tax on dividends

- No estate tax

Why invest through Hong Kong?

- Hong Kong has no limitation on money wiring. Investment money can come and go freely

Why invest in Fixed Income Notes?

A Fixed Income Notes works in the same way as a Corporate Bond. It is a great way to invest in China markets that you would otherwise have no access to. It is a hands-off alternative to volatile securities investment. For over a decade there has been an ineffective traditional company finance, resulting in Chinese companies looking for alternative ways to raise capital.

Learn More

What is Fixed Income Notes?

- Fixed Income Notes are a hands-off alternative to volatile securities investments

Investment return 8% per year

- The investment return is 8% annually. With a quarterly distribution of investment return

Cutting through the Complexity

- We aim to apply ML algorithms with historical transactions and other market data to search for best investment opportunities

Safe to Invest

- Supported by Hong Kong Securities and Futures Commission licensed corporation

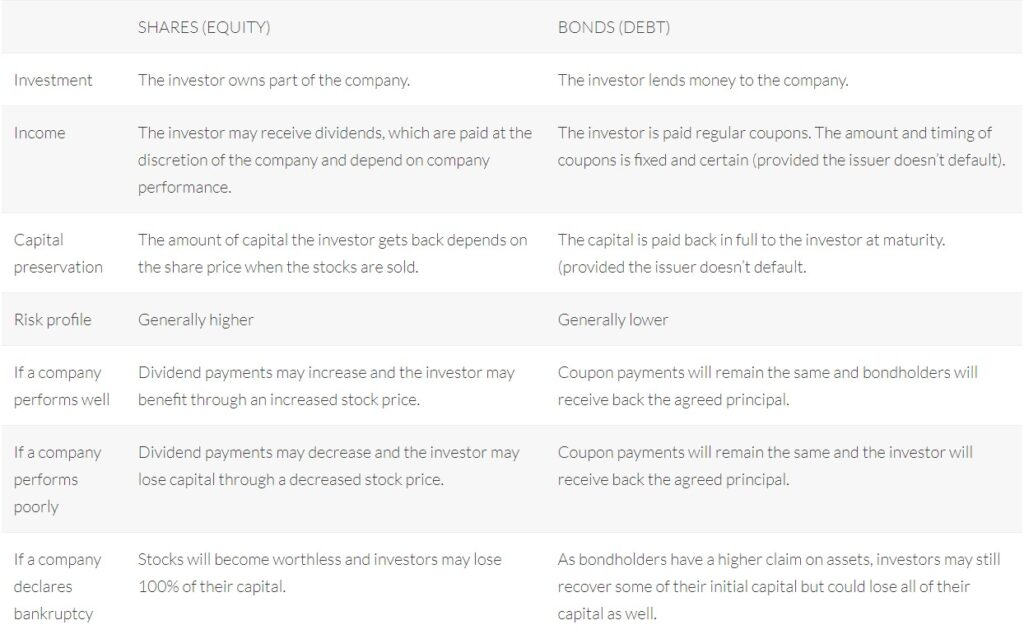

Bonds VS Shares

How are bonds different from stocks?

Most investors have a good understanding of stocks and how they work. A great way to make bond investing easy to understand is to leverage these familiar concepts.

Similarities and Differences

If investors want to invest in a company, they can choose to purchase its stock or its bonds. Both are a way for the company to raise money needed to fund its activities. The overall mix of debt and equity that the company uses is referred to as its capital structure. If investors buy stocks in the company, they become part-owners of the company. If investors buy the company’s bonds, then they become lenders to the company. There are several key differences between an investment in bonds and an investment in stocks, as highlighted in the table below.

Let’s Look At An Example

A key difference between bonds and stocks is the predictability of returns, with bonds in general providing relatively more certainty. For example, let’s look at the differences between a $2,000 investment in a fixed rate 10-year bond with an annual coupon of 5% and a $2,000 investment in stocks with a 5% dividend yield.

At first glance they look very similar, however there are two key differences.

The value of the bond’s coupon payments is fixed at $100 per year, while the stock’s dividend payment can differ each year.

The upfront investment of $2,000 in the bond will be repaid at maturity, while the investment in the stock could be worth more or it could be less depending on the stock price.

The Risk-Return Profiles of Bonds VS Shares

During recent decades, bonds have evolved into a $100 trillion global market. Not surprisingly, there is a wide range of bonds available, each offering different risk and return profiles.

Most bond investments, however, seek to provide regular income and capital preservation. As such, they are generally considered to be a lower risk investment when compared with stocks.

The chart below provides a high-level overview of where bonds fall on the risk and return spectrum relative to stocks and several other asset classes.

Bond for Beginner:How to Buy Bond

Hong Kong Bond Market

According to latest report by the International Capital Market Association (ICMA), Hong Kong is the largest centre for arranging Asian international bond issuance, capturing 34% (or US$196 billion) of Asian international bonds in 2020, followed by the US (18%), the UK (17%) and Singapore (5%). Hong Kong is also well ahead of other major international financial centres in terms of arranging first-time bond issuance, capturing 75% (US$18 billion) of the Asian market versus Singapore (9%) and the UK (5%). In terms of listing of Asian international bonds, Hong Kong comes second (28%), which is well ahead of Luxembourg (17%) and the UK (4%), and only slightly behind Singapore (31%).

Hong Kong Bond Trade

Currently, you can buy bonds from brokerages or banks or subscribe directly from issuers during the Initial Public Offering (IPO) of the bond. If bonds are listed on the stock exchange, they can be traded like listed stocks. For unlisted bonds, investors can only trade them on the secondary market via their banks.

How can I buy bond Hong Kong locally?

You can subscribe for a newly issued bond via an IPO at its subscription price. You can also buy bonds that are already trading in the secondary market. If the bond is listed on an exchange, trading process is generally similar to that of stocks listed on that exchange. In the secondary market, bond dealers are connected via electronic terminals that display the latest information on indicative bond prices. Private negotiation usually happens offline between the buyer and the seller. Some brokerages may hold inventories of bonds that they wish to sell to their clients. A larger bid-offer spread is likely if a bond is infrequently traded.