The classification of bonds

The good news for investors is that it is relatively straightforward to generally assess the risk profile of a bond, with much of the detailed research carried out by external credit rating agencies. The three most significant firms in the market are Standard & Poor’s (S&P), Moody’s and Fitch, who screen the bond universe to decide which are investment grade or high yield instruments.

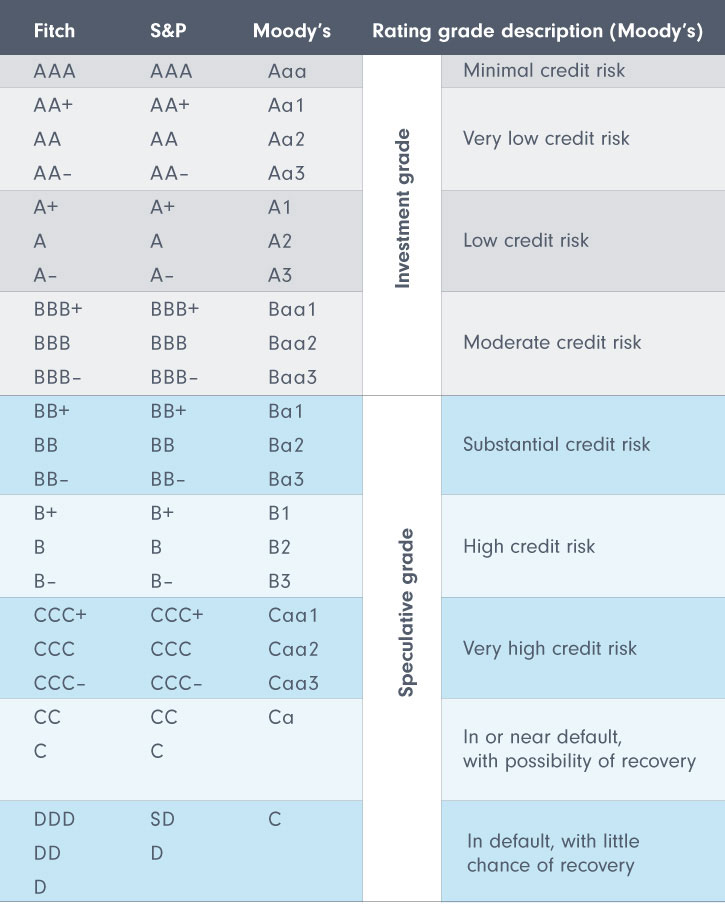

If we take S&P’s classification system as an example, it assigns different credit ratings, based on how much risk is attached to the repayment of capital. These comprise one to three letters such as ‘AAA’, ’BB’ or ‘C’ (with ‘+’ or ‘–’ signs providing further differentiation).

There is a dividing line: bonds with good credit ratings of at least ’BBB –’ are classed as investment grade bonds, while those below ‘BBB–’ are treated as high yield bonds (also known as speculative or junk bonds).

Moody’s rating scale is slightly different from but broadly similar to that of Fitch and S&P.As an aside, government bonds are classified in much the same way. Therefore, the US’s debt might be ranked investment grade with Venezuela’s deemed high yield.

Some institutional investors, such as pension funds, are scale-bound when selecting bonds for their portfolios: they must differentiate between investment grade bonds and high yield instruments. For example, the Default Investment Strategy of Hong Kong’s Mandatory Provident Fund (MPF) has two constituent funds. There is a ‘conservative’ fund which is weighted more towards lower-risk assets, such as government and investment grade bonds.

However, there is also a more ‘aggressive’ fund which holds a proportionately greater number of higher-risk assets such as equities and high yield bonds.

Bonds’ credit ratings may also be upgraded or downgraded over time. Therefore, investment grade bonds could become high yield bonds – the so called ‘fallen angels’.

For enquires, please call (852) 3892-5812 Or email us : [email protected]

Peace-of-mind procedure! Free Capital Flow! High yield stable income!

#roboadvisor #bond #chinabond #chinesehighyieldbond #bondyield #bonds #rmbbond #chinabonds #realestate #rmbbonds #renminbibonds #onshorebonds #bondfund