If you can’t or don’t want to borrow money from a brick-and-mortar bank or a conventional online lender, peer-to-peer (P2P) lending is an option worth exploring. P2P lending works differently from the financing you may have received in the past.

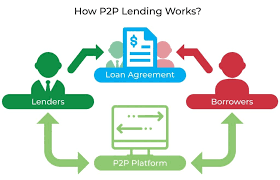

You are not borrowing from a financial institution but rather from an individual or group of individuals who are willing to loan money to qualified applicants. P2P lending websites connect borrowers directly to investors, as these lenders are called. Each website sets the rates and the terms (sometimes with investor input) and enables the transaction.

P2P has only existed since 2005, but the crowd of competing sites is already considerable. While they all operate the same basic way, they vary quite a bit in their eligibility criteria, loan rates, amounts, and tenures, as well as their target clientele. To jump-start your search, we scoured the online P2P marketplace and came up with these top 6 platforms, depending on your exact financial situation.