Bonds Lose Money When Interest Rates Rise

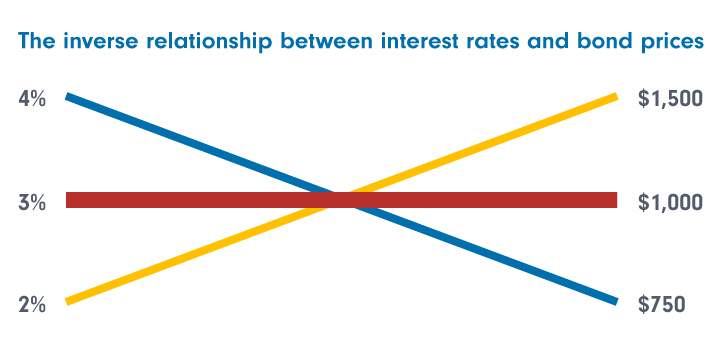

It is common knowledge that bond prices and interest rates are negatively correlated – that is, when one rises, the other falls. However, the relationship is not always that straightforward. Bond yields are a reflection of both the interest rate environment, as well as the credit risk of the issuer. For risk-free sovereign bonds, the inverse relationship between interest rates and bond prices generally holds true.

However, for corporate bonds which entail some credit risk, the relationship may not be that straightforward. Interest rates tend to rise when economic growth improves; the perceived default risk may be lower as investors expect fewer corporate defaults under stronger economic conditions. As such, it may be the case that corporate bond yields actually decline even as interest rates rise.

For enquires, please call (852) 3892-5812 Or email us : [email protected]

Peace-of-mind procedure! Free Capital Flow! High yield stable income!

#roboadvisor #bond #chinabond #chinesehighyieldbond #bondyield #bonds #rmbbond #chinabonds #realestate #rmbbonds #renminbibonds #onshorebonds #bondfund